Printable Itemized Deductions Worksheet

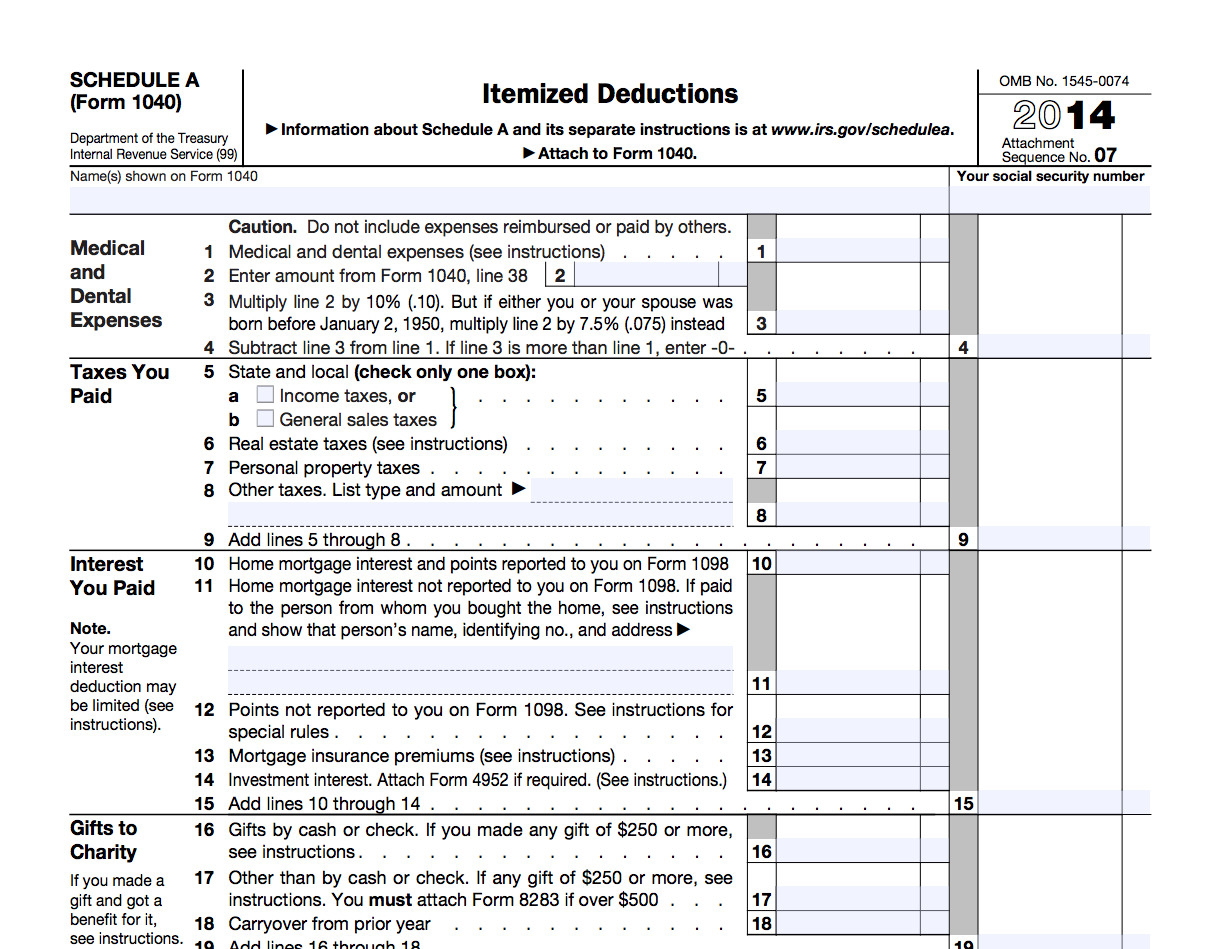

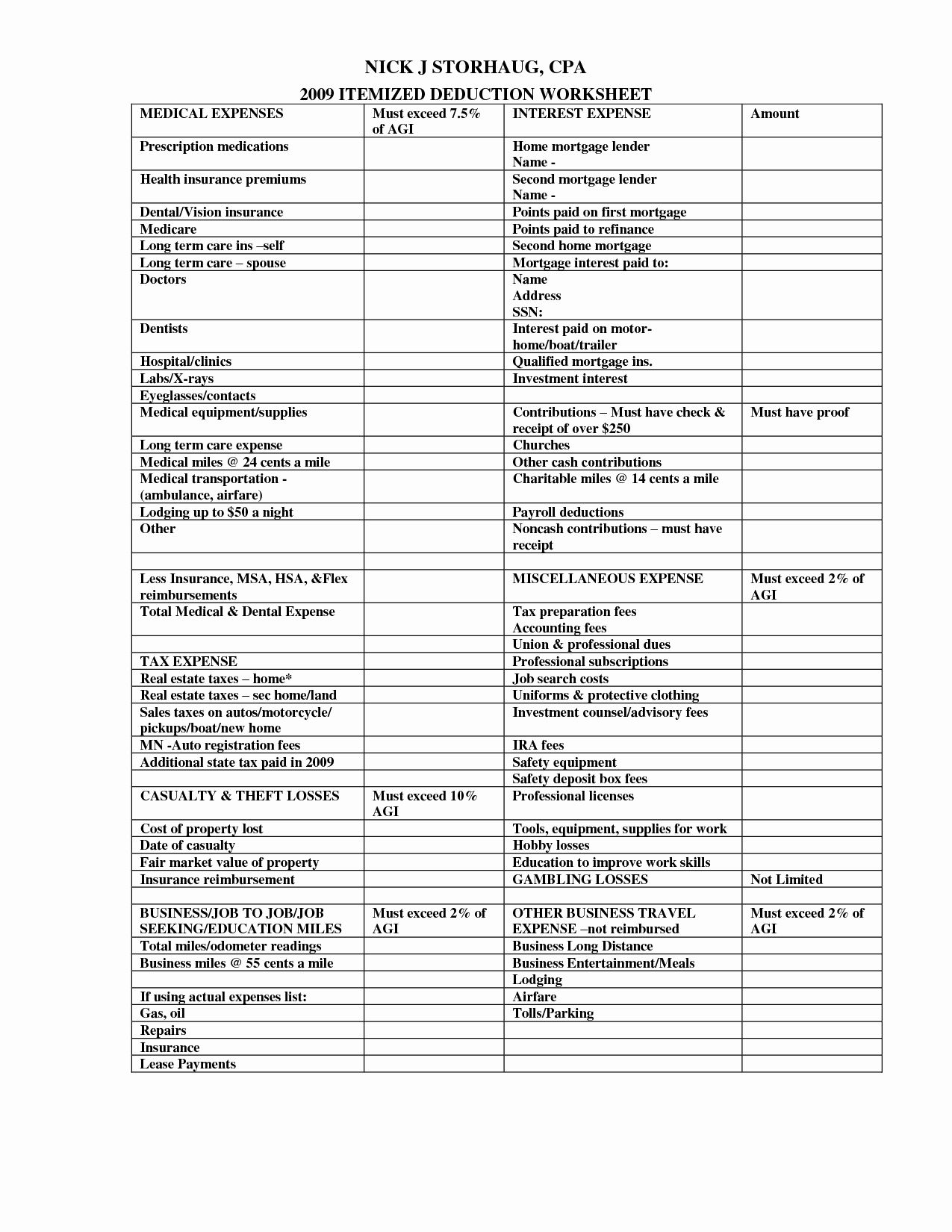

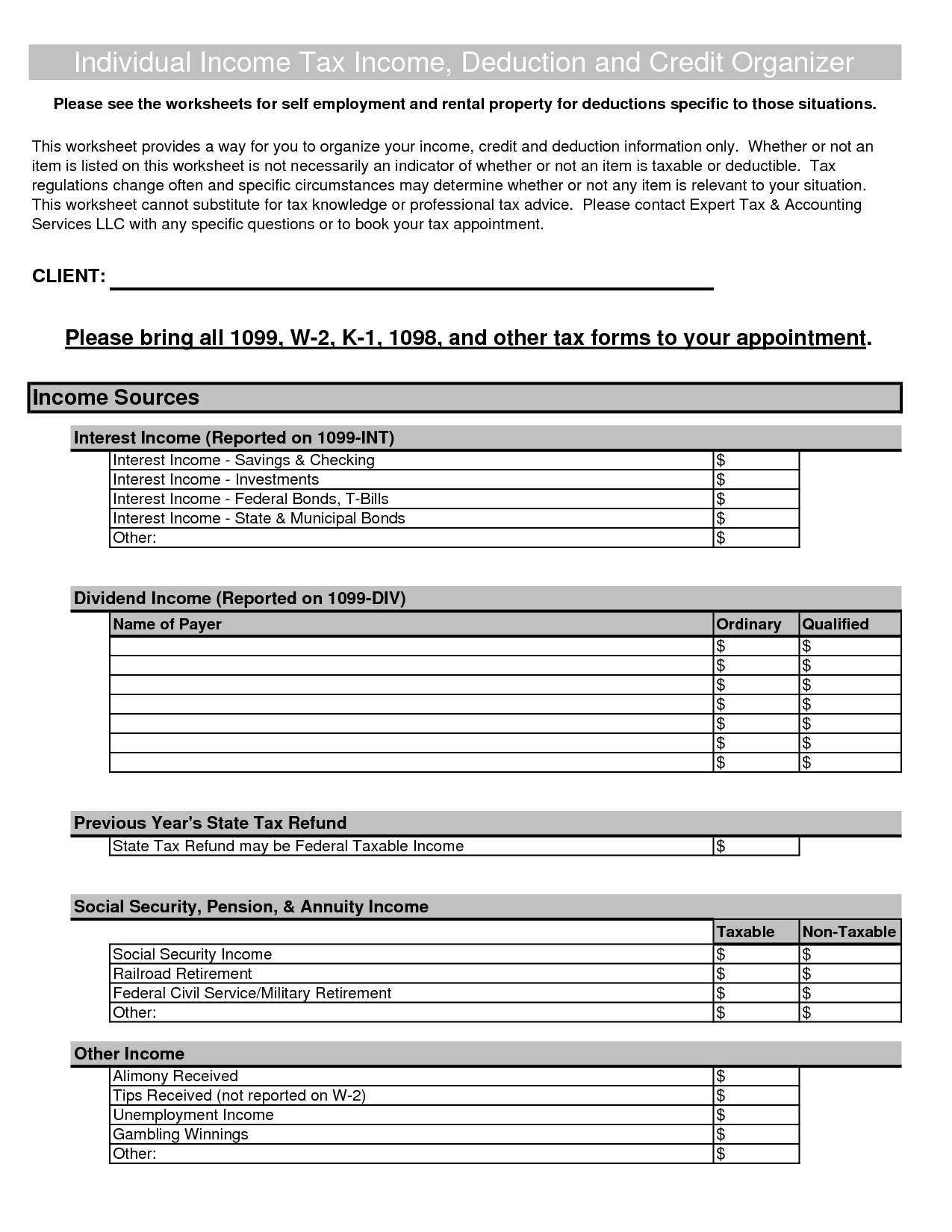

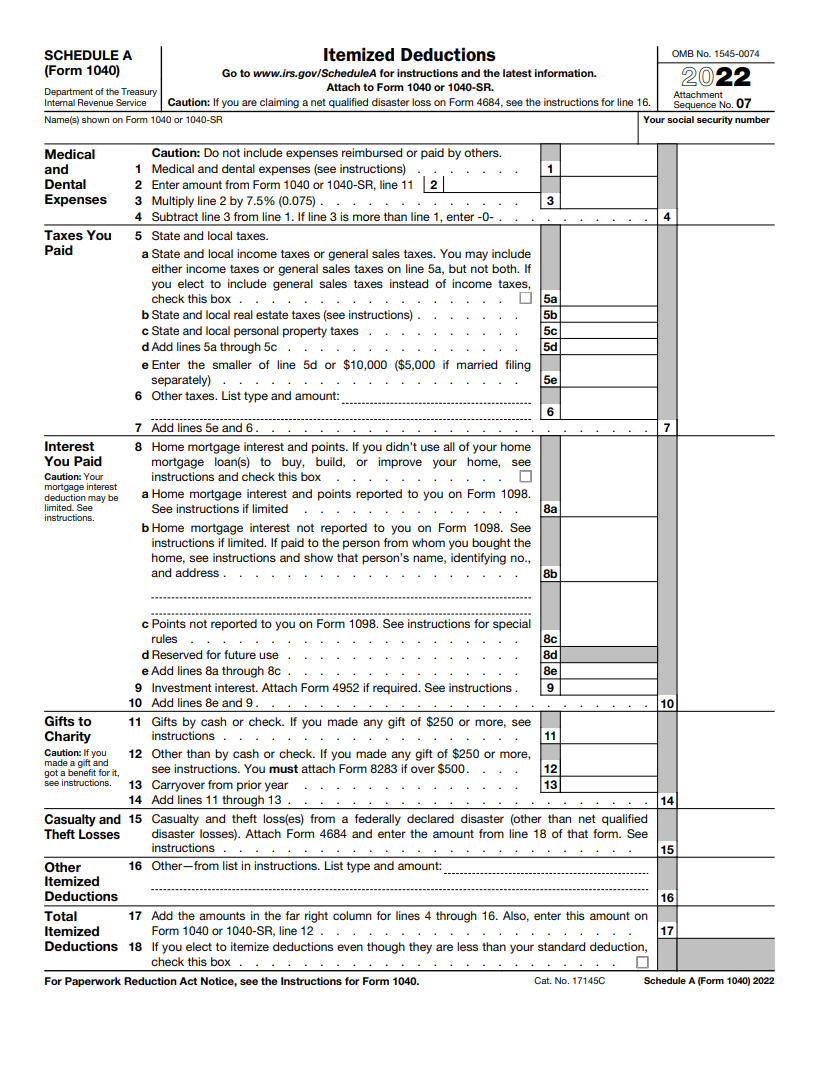

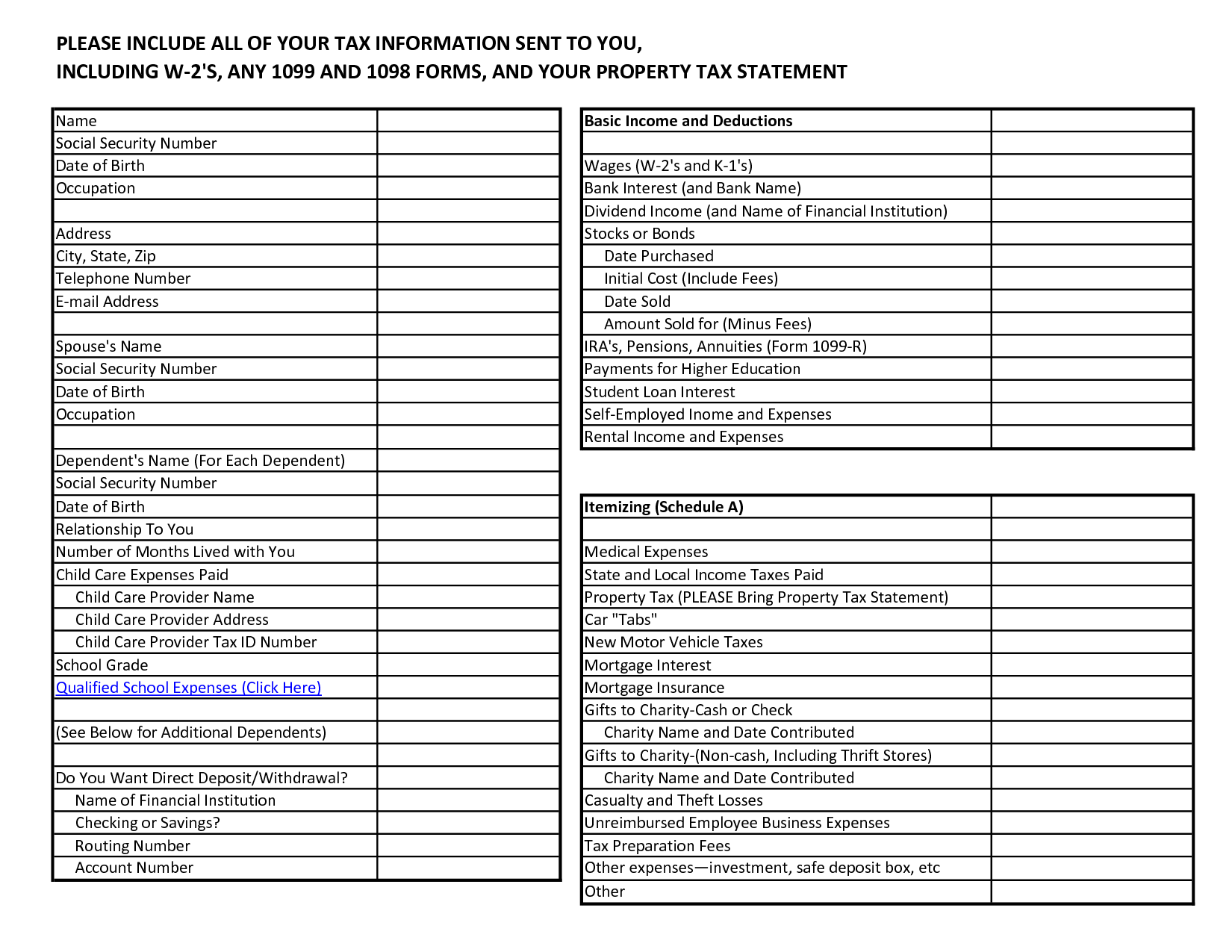

Printable Itemized Deductions Worksheet - The source information that is required for each tax return is. Download the free itemized deductions checklist to keep track of your tax information throughout the entire year. Enter the first description, the amount, and. It's essential for accurately reporting deductible expenses like medical. This worksheet helps you itemize deductions for your 2023 tax return. Your 2023 itemized deduction worksheet itemized deductions need to be more than your standard deduction. We’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550 if married): $14,600 for singles, $21,900 for heads of household and $29,200 for. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Enter the first description, the amount, and. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. 2023 itemized deductions worksheet for tax filing. Medical and dental expenses are deductible only to the extent they exceed 7.5% of your adjusted gross income for tax year 2024 and are not reimbursed/paid by insurance. We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): Otherwise, reporting total figures on this form. Download the free itemized deductions checklist to keep track of your tax information throughout the entire year. Your 2024 itemized deduction worksheet itemized deductions need to be more than your standard deduction. Itemized deductions, also known as itemized deduction or itemized deductions form, are specific expenses that qualify for a deduction according to the internal revenue service (irs). We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add. Go to www.irs.gov/schedulea for instructions and the latest information. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your. However, these expenses may still be. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Your 2023 itemized deduction worksheet itemized deductions need to be more than your standard deduction. It's essential for accurately reporting deductible expenses like medical. Miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. We’ll use your 2021 federal standard deduction shown. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): In most cases, your federal income tax will be less if you take the larger of your itemized. $13,850 for singles, $20,800 for heads of household and $27,700 for. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Otherwise, reporting total figures on this form. The source information that is required for each tax return is. Medical and dental expenses are deductible only. Miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if. Enter the first description, the amount, and. Go to www.irs.gov/schedulea for instructions and the latest information. Otherwise, reporting total figures on this form. This worksheet helps you itemize deductions for your 2023 tax return. Your 2023 itemized deduction worksheet itemized deductions need to be more than your standard deduction. Enter the first description, the amount, and. Otherwise, reporting total figures on this form. $13,850 for singles, $20,800 for heads of household and $27,700 for. Medical and dental expenses are deductible only to the extent they exceed 7.5% of your adjusted gross income for tax year 2024 and are not reimbursed/paid by insurance. Your 2024 itemized deduction worksheet itemized deductions. However, these expenses may still be deductible on your state return. However, keep in mind that your property taxes of up to $10,000 are an itemized deduction, too—and combined with mortgage interest and other deductions, could push you. 2023 state taxes paid in 2024 goodwill/salvation army. We’ll use your 2022 federal standard deduction shown below if more than your itemized. Your 2024 itemized deduction worksheet itemized deductions need to be more than your standard deduction. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. Otherwise, reporting total figures. Your 2024 itemized deduction worksheet itemized deductions need to be more than your standard deduction. Otherwise, reporting total figures on this form. 2023 itemized deductions worksheet for tax filing. We’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Go to www.irs.gov/schedulea for instructions and the latest information. Medical and dental expenses are deductible only to the extent they exceed 7.5% of your adjusted gross income for tax year 2024 and are not reimbursed/paid by insurance. Miscellaneous itemized deductions subject to the 2% agi limitation are no longer deductible on the federal return. However, these expenses may still be deductible on your state return. We’ll use your 2024 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,950 or $1,550 if married): We’ll use your 2021 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,700 or $1,350 if married): Tax information documents (receipts, statements, invoices, vouchers) for your own records. Download the free itemized deductions checklist to keep track of your tax information throughout the entire year. $13,850 for singles, $20,800 for heads of household and $27,700 for. Itemized deductions, also known as itemized deduction or itemized deductions form, are specific expenses that qualify for a deduction according to the internal revenue service (irs). Your 2023 itemized deduction worksheet itemized deductions need to be more than your standard deduction. 2023 state taxes paid in 2024 goodwill/salvation army.Itemized Deductions Worksheet —

Printable Itemized Deductions Worksheet

Itemized Deduction Small Business Tax Deductions Worksheet

Printable Itemized Deductions Worksheet

18 Itemized Deductions Worksheet Printable /

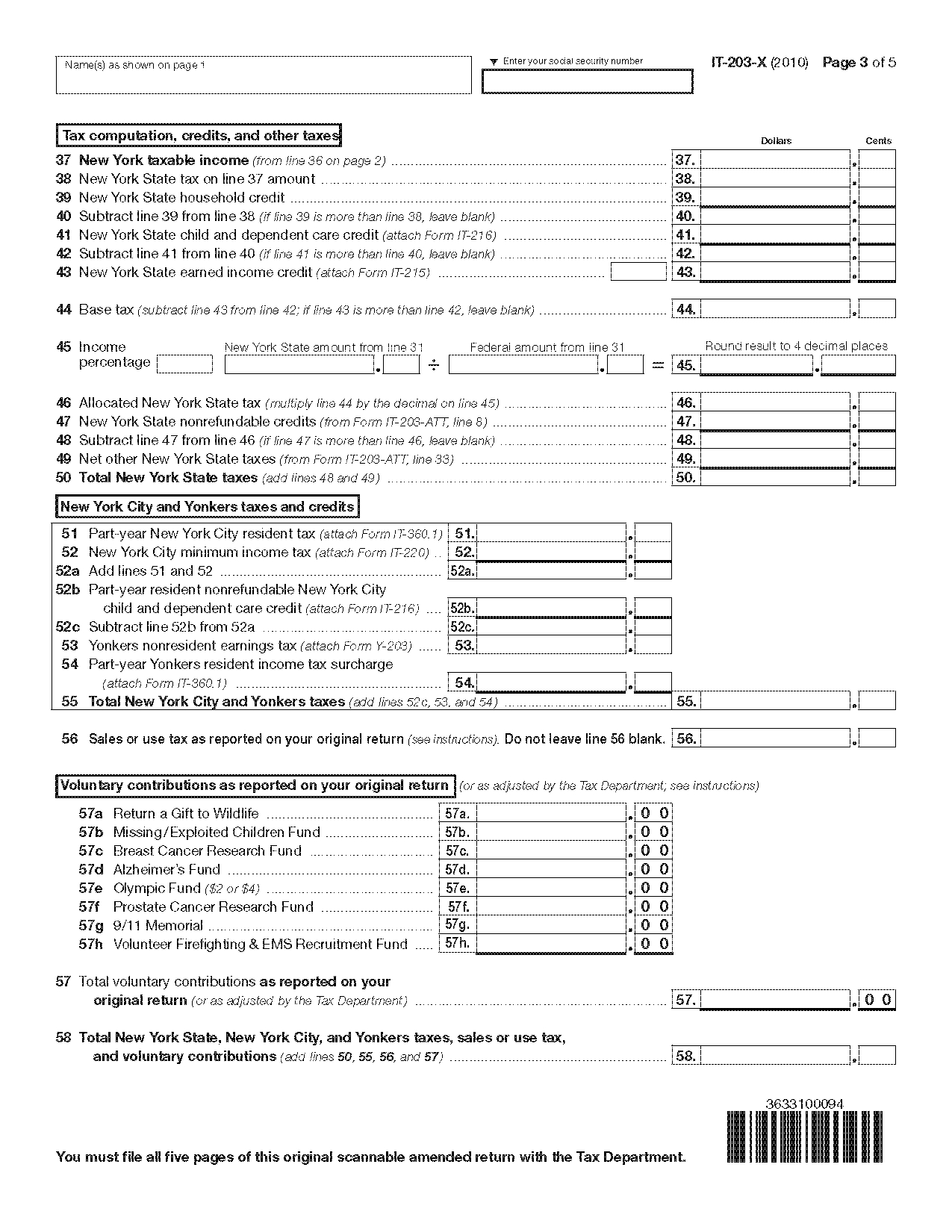

Schedule A (Form 1040) A Guide to the Itemized Deduction Worksheets

Tax Deductions Tax Deductions Worksheet —

Printable Itemized Deductions Worksheet

Tax Deductions Worksheets

itemized deductions worksheet 20212022 Fill Online, Printable

In Most Cases, Your Federal Income Tax Will Be Less If You Take The Larger Of Your Itemized Deductions Or Your.

It's Essential For Accurately Reporting Deductible Expenses Like Medical.

If You Are Claiming A Net Qualified Disaster Loss On Form 4684, See The Instructions For Line 16.

However, Keep In Mind That Your Property Taxes Of Up To $10,000 Are An Itemized Deduction, Too—And Combined With Mortgage Interest And Other Deductions, Could Push You.

Related Post: