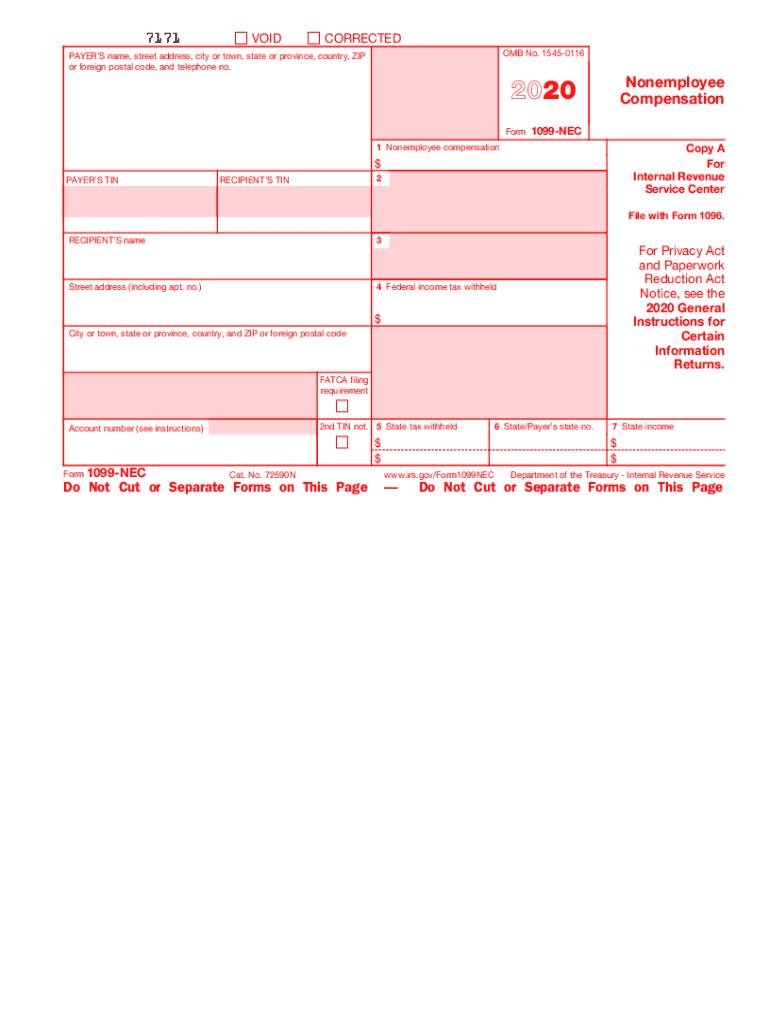

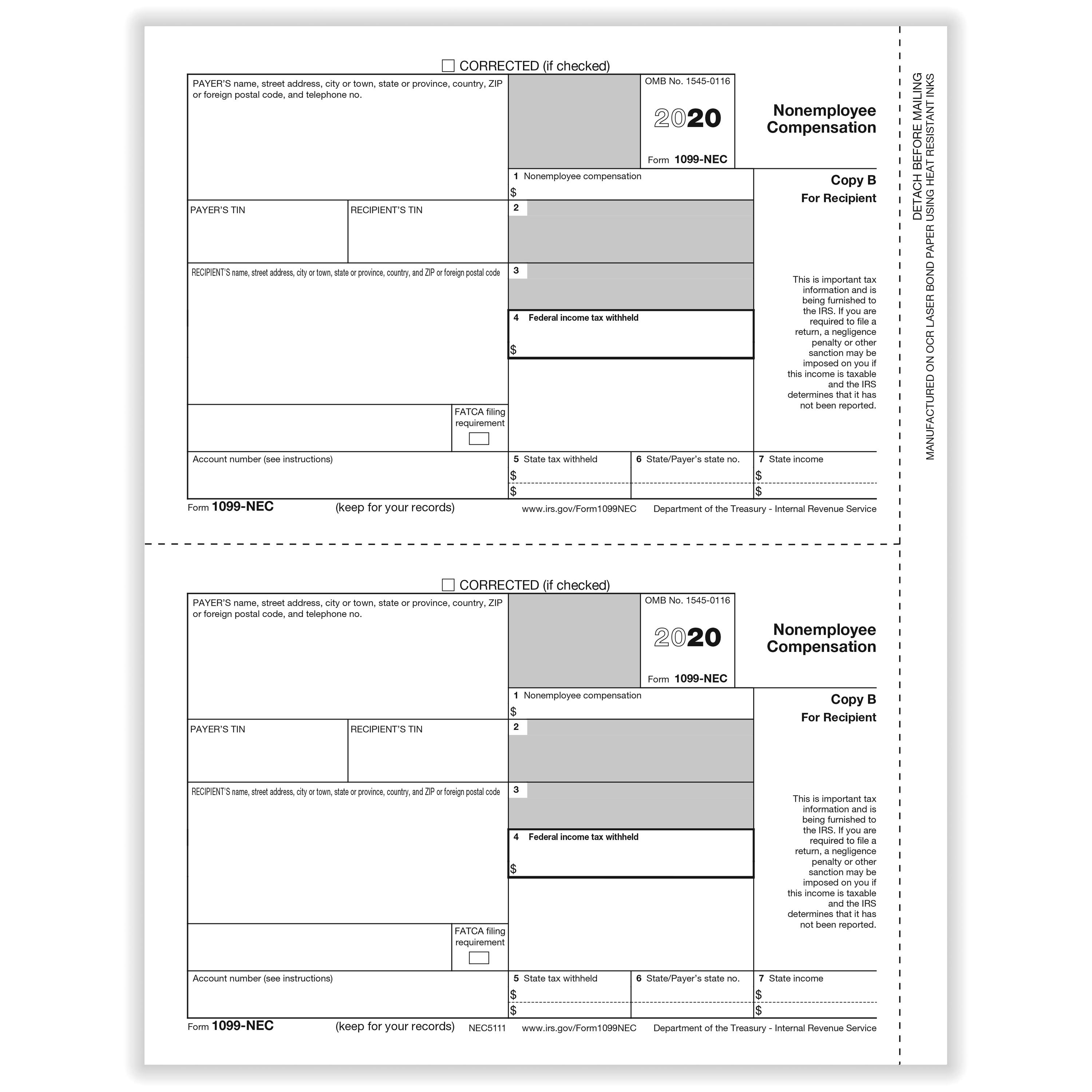

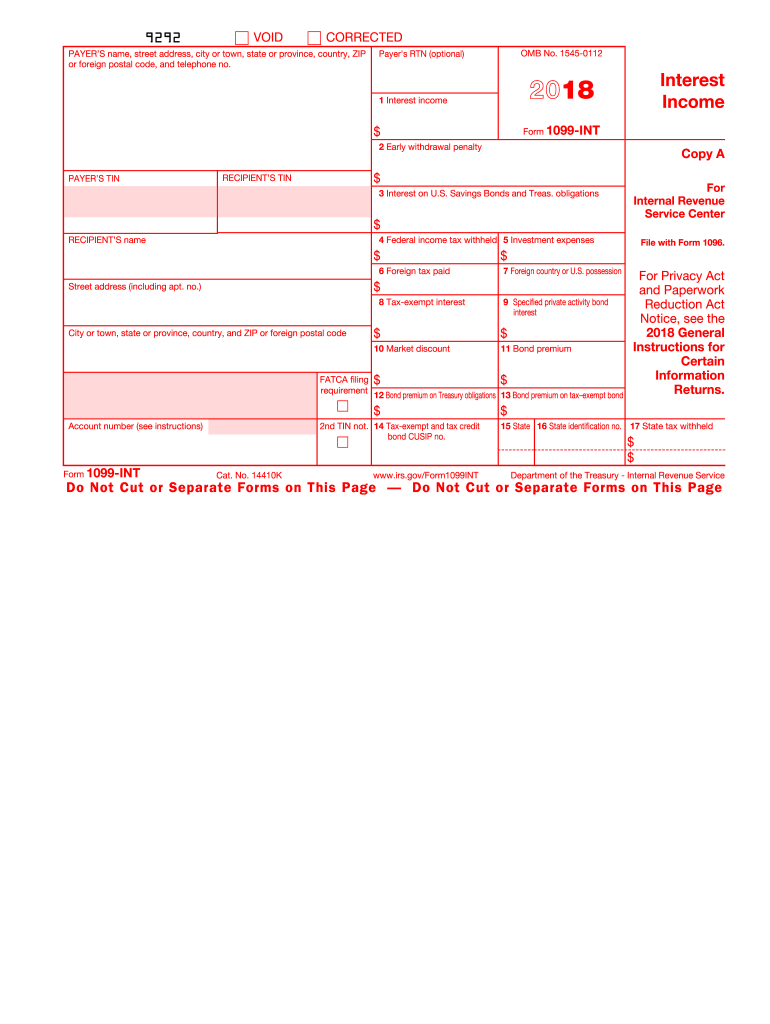

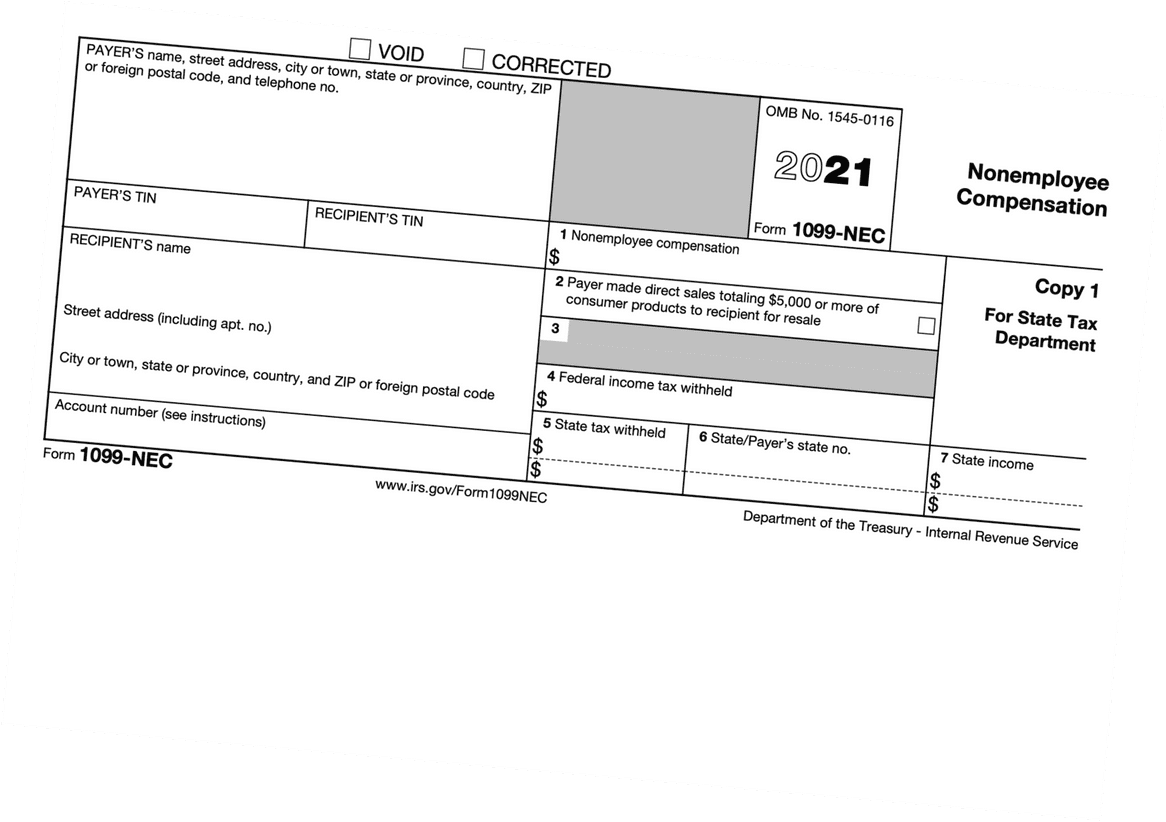

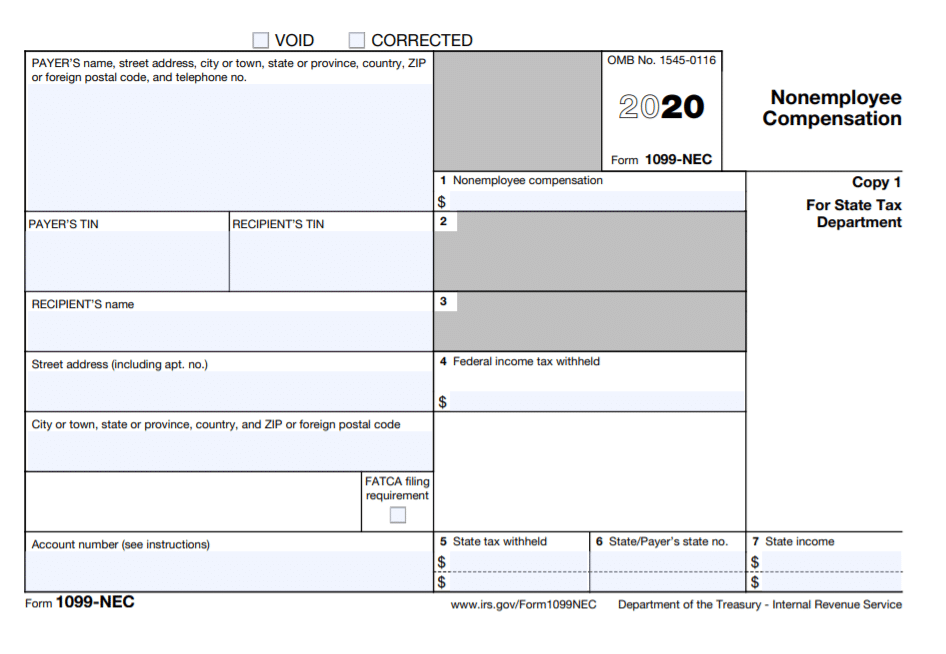

1099 Nec Form Printable

1099 Nec Form Printable - You must also complete form 8919 and attach it to your return. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu of. For more information, see pub. 1779, independent contractor or employee. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. For more information, see pub. You must also complete form 8919 and attach it to your return. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu of. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. 1779, independent contractor or employee. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu of. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. You must also complete form 8919 and attach it to your return. For more information, see. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu of. For more information, see pub. You must also complete form 8919 and attach it to your return. 1779, independent contractor or employee. For all other forms in the listing that follows, enter the total of the amounts from the. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu of. 1779, independent contractor or employee. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. For more information, see pub. You must also complete form 8919. 1779, independent contractor or employee. You must also complete form 8919 and attach it to your return. For more information, see pub. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. Report payments of $10 or more made in the course of a business in royalties. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. 1779, independent contractor or employee. You must also complete form 8919 and attach it to your return. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu. 1779, independent contractor or employee. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu of. For more information, see pub. You must also complete form 8919. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu of. You must also complete form 8919 and attach it to your return. For more information, see pub. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. For more information, see pub. 1779, independent contractor or employee. You must also complete form 8919 and attach it to your return. Report payments of $10 or more made in the course of a business in royalties. 1779, independent contractor or employee. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. For more information, see pub. You must also complete form 8919 and attach it to your return. Report payments of $10 or more made in the course of a business in royalties. 1779, independent contractor or employee. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu of. For more information, see pub. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. You must also complete form 8919. Report payments of $10 or more made in the course of a business in royalties or broker payments in lieu of. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. You must also complete form 8919 and attach it to your return. 1779, independent contractor or employee.Printable Form 1099nec 2022

Printable 1099 Nec 2024

Printable Form 1099 Nec

How to File Your Taxes if You Received a Form 1099NEC

Fillable Form 1099 Nec Printable Forms Free Online

Printable Fillable 1099 Nec

Irs 1099 Nec Form 2023 Printable Free

Free 1099nec Form Printable

Irs 1099 Nec Form 2024 Online Annie Brianna

Printable 1099 Nec Form 2024

For More Information, See Pub.

Related Post: